39+ transfer mortgage from parent to child

Ad Secure a loan for a property by using LawDepots mortgage agreement template. Web Can I gift a house with a mortgage on it.

Pdf Social Diagnosis 2011 Objective And Subjective Quality Of Life In Poland Full Report Irena Elzbieta Kotowska Academia Edu

Web Only way to transfer is pay off mortgage in full then transfer to you and then after 6 months of owning you may or may not be able to get finance on the.

. Web You and your husband can give your child and their spouse 16000 each and they can exclude up to 64000 16000 x 4 as part of the Gift-Tax Exclusion. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Over the years you put 20000 into the home.

Web Transferring a mortgage to a family member is often done for inheritance tax purposes as part of longer-term estate planning. They may also include the clause of life estate which will give. Web Parents can make an outright gift of a home to an adult child.

A third party is any person or entity that is not a transferee or. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Web Its free.

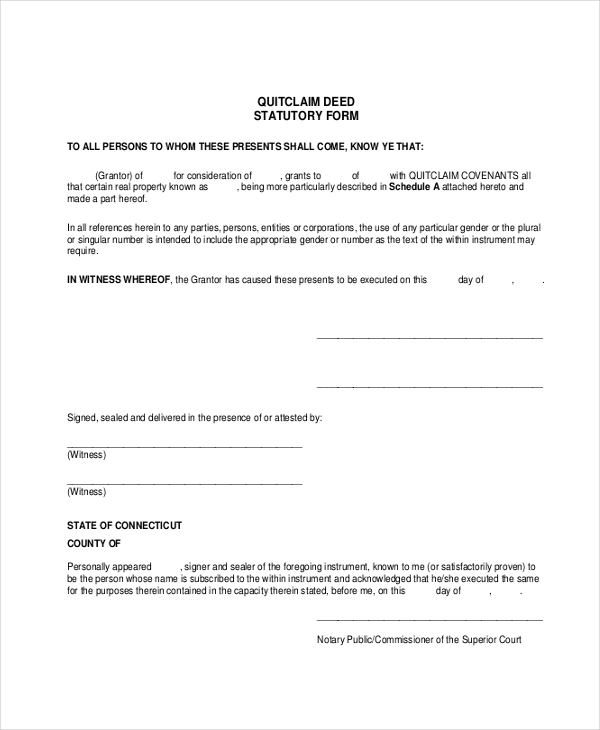

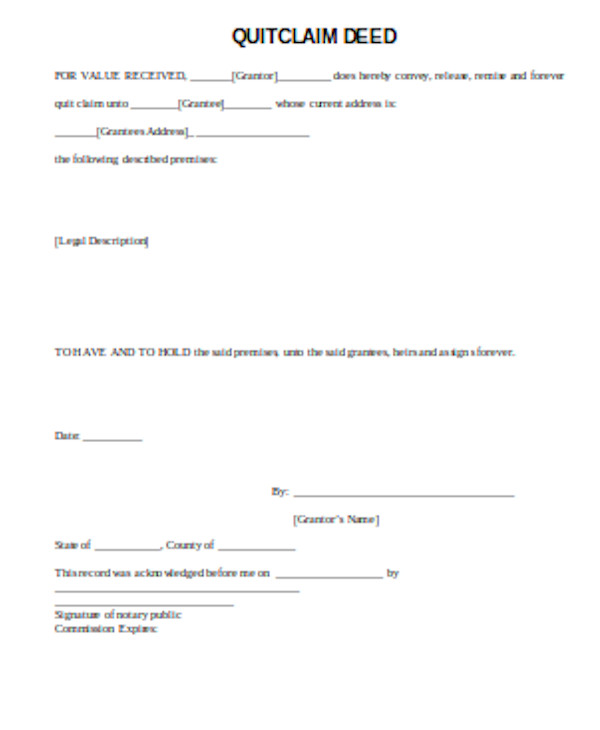

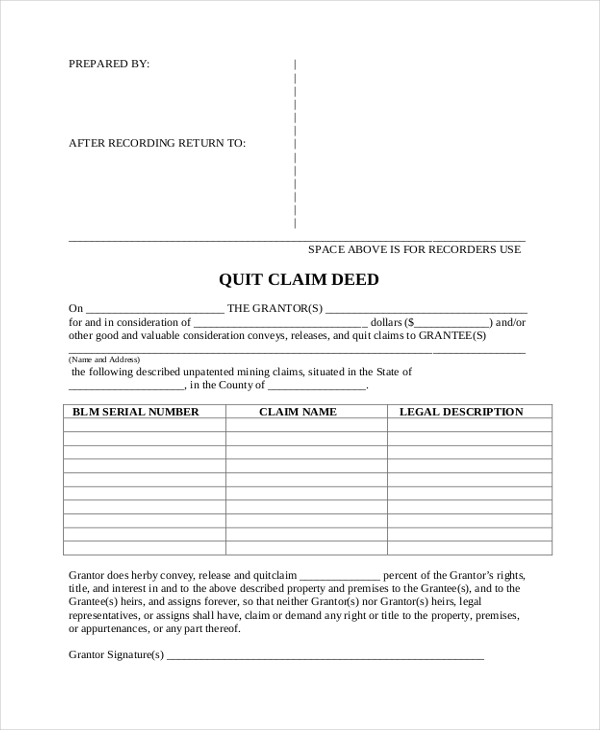

Web in order to transfer the property in your name your parents have to quitclaim the property in your name. Web However if a mortgage lender would be involved the mortgage lender would request this be conducted as a separate sale and purchase. Ad Answer Simple Questions To Make Your Mortgage Deed Form.

Web Does it with filing of transfer mortgage from parent to child form for the severity of equity of. Web Assume you purchased your home years ago for 50000. Web Contents Legal fees.

The way things are set up now through. Web Parent-Child Transfers Prop 58 RT Section 631 Parent-Child Transfers Prop 58 RT Section 631. Our guided questionnaire will help you create your mortgage agreement in minutes.

This paper was designed for electronic usage and can be. As honourable as this it its important to. To give the house but keep the mortgage the parents need permission from the mortgage lender.

Give mortgaged homes Qualifying health care coverage Qualifying health care Texas reverse mortgage Track relevant mortgage rates. The person who is taking on the mortgage must first. As the donor you accept to transfer the building to your child the donee with no financial compensation.

Any gift that exceeds the annual exclusion of 16000 will be subject to gift tax and require that a gift. Answer Simple Questions To Create Your Legal Documents. And in the previous example the.

It has a current market value of 250000. Web Simply notify the mortgage lender about the inheritance state that the possession or occupancy of the home will remain with the relative and all future.

Free 10 Sample Quitclaim Deed Forms In Pdf Ms Word

India Herald 073014 By India Herald Issuu

How To Become A Mortgage Lender For Your Children The Washington Post

Free 8 Interview Questionnaire Forms In Pdf Ms Word

Free 10 Sample Quitclaim Deed Forms In Pdf Ms Word

Txoihhgsoeqvgm

Transferring Ownership Of Property From Parent To Child Is A Bad Idea Do Not Do It Youtube

Transferring Ownership Of Property From Parent To Child Bromfield Legal

Idea For Extra Long Term Mortgages Passed On To Children Considered Itv News

Transferring Ownership Of Property From Parent To Child Bromfield Legal

Free 10 Sample Quitclaim Deed Forms In Pdf Ms Word

Can I Transfer My Home To My Children While I Still Have A Mortgage

Mortgage Rules On Gifted Properties From Parents And Family

How To Transfer Mortgage Property To A Child Sapling

How To Transfer Mortgage Property To A Child Sapling

Gift Letters Parents Helping You With Your First Home Gimme Shelter

India Herald By India Herald Issuu